Pricing Games/prisonerã¢â‚¬â„¢s Dilemma: Upload Your Analysis to the Link for Week 6 on the Left Nav Bar

Learning Objectives

- Explain the role of game theory in understanding the behavior of oligopolies

Prisoner'southward Dilemma

Because of the complication of oligopoly, which is the result of common interdependence amid firms, in that location is no single, generally-accepted theory of how oligopolies behave, in the same way that we have theories for all the other market structures. Instead, manyeconomists use game theory, a co-operative of mathematics that analyzes situations in which players must brand decisions and and then receive payoffs based on what other players decide to practice. Game theory has found widespread applications in the social sciences, as well every bit in business organization, law, and military strategy.

A fundamental element of game theory is the concept of Nash equilibrium. The concept was developed by John Nash, an American mathematician who was awarded the 1994 Nobel Prize in economic science for this work. A Nash equilibrium occurs when no player has an incentive to change their decision, taking into account what the players have decided and bold the other players don't change their decisions. Thus, all players have fabricated an optimal decision, given the decisions of the other players.

The prisoner'southward dilemma is a scenario in which the gains from cooperation are larger than the rewards from pursuing self-involvement. It applies well to oligopoly. The story behind the prisoner's dilemma goes similar this:

Two co-conspiratorial criminals are arrested. When they are taken to the police station, they refuse to say annihilation and are put in separate interrogation rooms. Somewhen, a law officeholder enters the room where Prisoner A is existence held and says: "You know what? Your partner in the other room is confessing. Then your partner is going to get a light prison house sentence of merely ane year, and considering you're remaining silent, the guess is going to stick you lot with eight years in prison house. Why don't you get smart? If yous confess, too, we'll cut your jail time down to five years, and your partner will go v years, as well." Over in the side by side room, another law officer is giving exactly the same oral communication to Prisoner B. What the police officers do not say is that if both prisoners remain silent, the bear witness against them is not particularly strong, and the prisoners will finish upward with only two years in jail each.

The game theory situation facing the ii prisoners is shown in Table 1. To understand the dilemma, first consider the choices from Prisoner A's point of view. If A believes that B will confess, then A ought to confess, too, so as to non get stuck with the eight years in prison. Merely if A believes that B will not confess, then A volition be tempted to human activity selfishly and confess, so as to serve only i year. The key point is that A has an incentive to confess regardless of what option B makes! B faces the same set of choices, and thus will take an incentive to confess regardless of what choice A makes. Confess is considered the ascendant strategy or the strategy an private (or firm) will pursue regardless of the other individual's (or firm's) conclusion. The effect is that if prisoners pursue their ain self-interest, both are probable to confess, and end upwardly doing a total of 10 years of jail time between them. You should note that this outcome is a Nash equilibrium.

| Prisoner B | |||

| Remain Silent (cooperate with other prisoner) | Confess (practise not cooperate with other prisoner) | ||

| Prisoner A | Remain Silent (cooperate with other prisoner) | A gets ii years, B gets 2 years | A gets 8 years, B gets i twelvemonth |

| Confess (do not cooperate with other prisoner) | A gets 1 year, B gets 8 years | A gets 5 years B gets 5 years | |

The game is called a dilemma considering if the two prisoners had cooperated past both remaining silent, they would merely have had to serve a total of four years of jail fourth dimension between them. If the ii prisoners can work out some way of cooperating so that neither 1 will confess, they will both be better off than if they each follow their own individual self-involvement, which in this case leads straight into longer jail terms.

The Oligopoly Version of the Prisoner's Dilemma

The members of an oligopoly can face up a prisoner'south dilemma, also. If each of the oligopolists cooperates in holding down output, then high monopoly profits are possible. Each oligopolist, however, must worry that while it is belongings down output, other firms are taking reward of the high cost by raising output and earning higher profits. Tabular array 2 shows the prisoner's dilemma for a two-firm oligopoly—known as a duopoly. If Firms A and B both agree to hold down output, they are acting together as a monopoly and will each earn $1,000 in profits. Nonetheless, both firms' ascendant strategy is to increase output, in which example each will earn $400 in profits.

| Firm B | |||

| Hold Down Output (cooperate with other firm) | Increase Output (exercise not cooperate with other firm) | ||

| Firm A | Hold Downward Output (cooperate with other business firm) | A gets $1,000, B gets $1,000 | A gets $200, B gets $1,500 |

| Increase Output (exercise not cooperate with other business firm) | A gets $ane,500, B gets $200 | A gets $400, B gets $400 | |

Tin the 2 firms trust each other? Consider the situation of Firm A:

- If A thinks that B will cheat on their understanding and increase output, then A will increment output, also, because for A the profit of $400 when both firms increase output (the bottom right-hand choice in Table 2) is improve than a turn a profit of only $200 if A keeps output low and B raises output (the upper right-manus choice in the table).

- If A thinks that B will cooperate by property downwardly output, then A may seize the opportunity to earn higher profits by raising output. Later on all, if B is going to hold down output, then A can earn $1,500 in profits by expanding output (the bottom left-mitt choice in the table) compared with just $1,000 by property downwards output besides (the upper left-hand pick in the table).

Thus, business firm A will reason that information technology makes sense to expand output if B holds down output and that information technology also makes sense to expand output if B raises output. Once again, B faces a parallel fix of decisions.

The effect of this prisoner's dilemma is frequently that even though A and B could make the highest combined profits by cooperating in producing a lower level of output and acting like a monopolist, the ii firms may well end up in a situation where they each increase output and earn simply $400 each in profits. The following case discusses one cartel scandal in detail.

What is the Lysine cartel?

Lysine, a $600 million-a-yr industry, is an amino acid used by farmers as a feed additive to ensure the proper growth of swine and poultry. The primary U.South. producer of lysine is Archer Daniels Midland (ADM), but several other large European and Japanese firms are also in this market. For a time in the showtime one-half of the 1990s, the world'southward major lysine producers met together in hotel conference rooms and decided exactly how much each firm would sell and what information technology would charge. The U.S. Federal Agency of Investigation (FBI), yet, had learned of the cartel and placed wire taps on a number of their telephone calls and meetings.

From FBI surveillance tapes, following is a comment that Terry Wilson, president of the corn processing division at ADM, fabricated to the other lysine producers at a 1994 meeting in Mona, Hawaii:

I wanna become back and I wanna say something very simple. If nosotros're going to trust each other, okay, and if I'yard bodacious that I'm gonna get 67,000 tons by the twelvemonth'southward end, we're gonna sell information technology at the prices we agreed to . . . The but thing we need to talk about there because nosotros are gonna go manipulated past these [curse] buyers—they tin be smarter than us if nosotros allow them exist smarter. . . . They [the customers] are not your friend. They are non my friend. And nosotros gotta accept 'em, only they are not my friends. You are my friend. I wanna exist closer to you than I am to whatsoever customer. Cause you can make u.s. … money. … And all I wanna tell you over again is permit'south—allow'southward put the prices on the lath. Let's all hold that'south what nosotros're gonna do and so walk out of here and practise it.

The price of lysine doubled while the cartel was in effect. Confronted by the FBI tapes, Archer Daniels Midland pled guilty in 1996 and paid a fine of $100 million. A number of top executives, both at ADM and other firms, subsequently paid fines of up to $350,000 and were sentenced to 24–30 months in prison.

In another one of the FBI recordings, the president of Archer Daniels Midland told an executive from another competing firm that ADM had a slogan that, in his words, had "penetrated the whole visitor." The company president stated the slogan this way: "Our competitors are our friends. Our customers are the enemy." That slogan could stand as the motto of cartels everywhere.

How to Enforce Cooperation

How can parties who find themselves in a prisoner'southward dilemma situation avert the undesired consequence and cooperate with each other? The fashion out of a prisoner's dilemma is to find a way to penalize those who do not cooperate.

Perhaps the easiest approach for colluding oligopolists, as you lot might imagine, would exist to sign a contract with each other that they will hold output low and go along prices loftier. If a group of U.S. companies signed such a contract, nonetheless, it would be illegal. Certain international organizations, similar the nations that are members of the System of Petroleum Exporting Countries (OPEC), have signed international agreements to act similar a monopoly, concord down output, and proceed prices high so that all of the countries tin make high profits from oil exports. Such agreements, however, because they fall in a gray expanse of international law, are non legally enforceable. If Nigeria, for instance, decides to get-go cut prices and selling more oil, Saudi Arabia cannot sue Nigeria in court and force information technology to end.

Link It Upwardly

Visit the Organization of the Petroleum Exporting Countries website and acquire more than about its history and how it defines itself.

Because oligopolists cannot sign a legally enforceable contract to act like a monopoly, the firms may instead keep close tabs on what other firms are producing and charging. Alternatively, oligopolists may choose to human action in a way that generates pressure on each firm to stick to its agreed quantity of output.

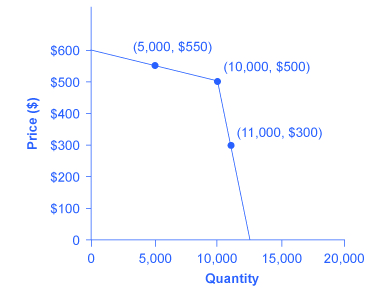

1 example of the pressure these firms can exert on one another is the kinked demand curve, in which competing oligopoly firms commit to match price cuts, but not price increases. This state of affairs is shown in Figure 1. Say that an oligopoly airline has agreed with the rest of a cartel to provide a quantity of 10,000 seats on the New York to Los Angeles route, at a price of $500. This option defines the kink in the house's perceived need curve. The reason that the firm faces a kink in its need bend is because of how the other oligopolists react to changes in the firm's cost. If the oligopoly decides to produce more and cutting its price, the other members of the cartel will immediately friction match whatsoever toll cuts—and therefore, a lower cost brings very petty increment in quantity sold.

If i house cuts its price to $300, information technology will be able to sell just 11,000 seats. However, if the airline seeks to raise prices, the other oligopolists will not enhance their prices, and and then the firm that raised prices will lose a considerable share of sales. For example, if the house raises its price to $550, its sales drop to 5,000 seats sold. Thus, if oligopolists always match price cuts past other firms in the dare, but exercise not match cost increases, so none of the oligopolists will accept a strong incentive to change prices, since the potential gains are minimal. This strategy tin piece of work like a silent form of cooperation, in which the cartel successfully manages to hold down output, increase price, and share a monopoly level of profits fifty-fifty without any legally enforceable agreement.

Effigy 1. A Kinked Demand Bend. Consider a member firm in an oligopoly cartel that is supposed to produce a quantity of x,000 and sell at a price of $500. The other members of the cartel can encourage this firm to honor its commitments by acting so that the firm faces a kinked demand bend. If the oligopolist attempts to expand output and reduce toll slightly, other firms likewise cut prices immediately—and then if the firm expands output to xi,000, the price per unit falls dramatically, to $300. On the other side, if the oligopoly attempts to raise its price, other firms will not do and so, and so if the firm raises its price to $550, its sales decline sharply to v,000. Thus, the members of a dare can bailiwick each other to stick to the pre-agreed levels of quantity and price through a strategy of matching all price cuts simply not matching whatever cost increases.

Many real-world oligopolies, prodded by economic changes, legal and political pressures, and the egos of their summit executives, become through episodes of cooperation and competition. If oligopolies could sustain cooperation with each other on output and pricing, they could earn profits as if they were a unmarried monopoly. All the same, each firm in an oligopoly has an incentive to produce more and grab a bigger share of the overall marketplace; when firms starting time behaving in this way, the market place outcome in terms of prices and quantity can be similar to that of a highly competitive market.

Watch It

Lookout this video to review the key characteristics of oligopolies and to see some applications of game theory and collusion.

Attempt It

Attempt Information technology

These questions allow y'all to get every bit much practice as you demand, as you can click the link at the meridian of the commencement question ("Endeavour another version of these questions") to get a new set up of questions. Do until y'all feel comfy doing the questions.

Try It

These questions let you to get equally much practise every bit you need, as you can click the link at the acme of the outset question ("Try another version of these questions") to become a new set of questions. Practice until you experience comfortable doing the questions.

Endeavour It

These questions allow you to get as much practise as you lot need, as you can click the link at the top of the outset question ("Attempt another version of these questions") to get a new set of questions. Practice until you feel comfy doing the questions.

Glossary

- duopoly:

- an oligopoly with but 2 firms

- game theory:

- a branch of mathematics that economists employ to analyze situations in which players must make decisions and so receive payoffs based on what decisions the other players make

- kinked need bend:

- a perceived need curve that arises when competing oligopoly firms commit to lucifer toll cuts, but not cost increases

- Nash equilibrium:

- solution to a game-theoretic scenario when no role player has an incentive to change their decision, taking into account what the players have decided and bold the other players don't change their decisions.

- prisoner'due south dilemma:

- a game in which the gains from cooperation are larger than the rewards from pursuing self-interest

Source: https://courses.lumenlearning.com/wmopen-microeconomics/chapter/prisoners-dilemma/

0 Response to "Pricing Games/prisonerã¢â‚¬â„¢s Dilemma: Upload Your Analysis to the Link for Week 6 on the Left Nav Bar"

Post a Comment